2025 Form 1040-SR: A Comprehensive Guide for Seniors

Overview of Form 1040-SR

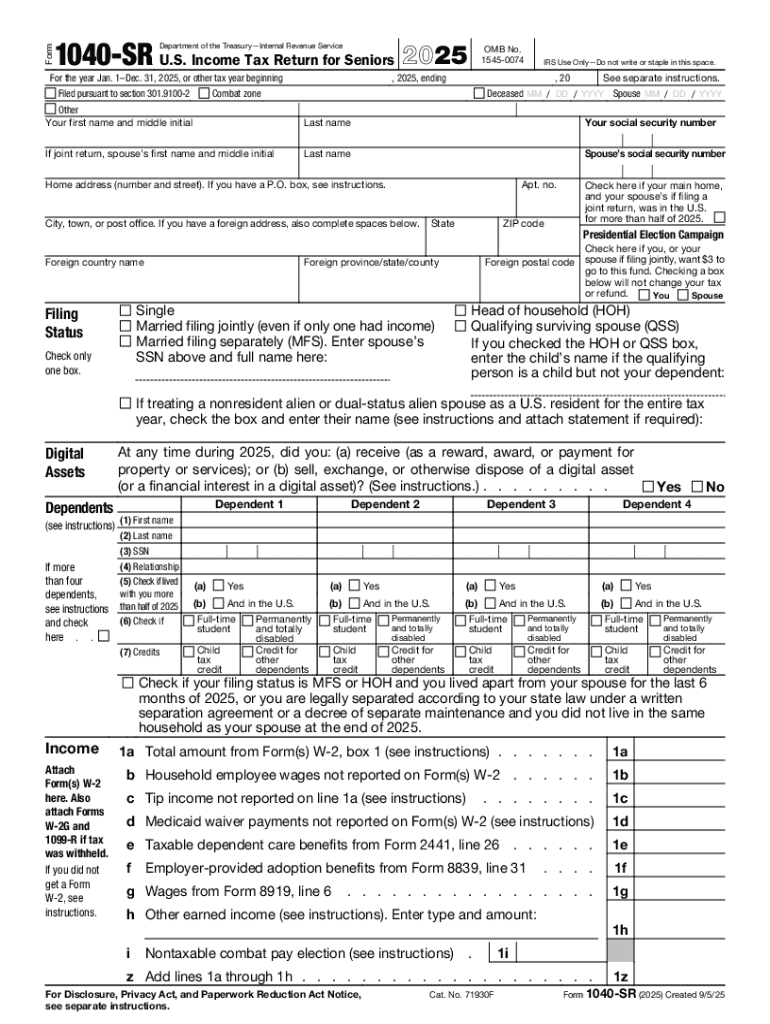

Form 1040-SR is designed specifically for seniors, age 65 and older, and serves as a straightforward alternative for reporting income taxes. Its primary purpose is to simplify the filing process for older taxpayers, who often have different financial situations compared to younger filers. This tax form has become increasingly important as the aging population continues to grow. With a focus on clarity and ease of use, Form 1040-SR caters to a demographic that benefits from streamlined instructions and larger print.

Key differences between Form 1040-SR and other tax forms lie in its unambiguous language and layout, which reduces the complexities commonly found in standard forms. For instance, unlike Form 1040, Form 1040-SR includes a standard deduction table right on the form, allowing seniors to quickly reference deduction amounts without needing to search through accompanying documents. Moreover, individuals who might not have access to sophisticated tax software would find this form particularly user-friendly.

Easier readability and larger print for clarity.

Includes a standard deduction table for senior taxpayers.

Tailored instructions specific to seniors.

Seniors and retirees with relatively simple tax situations, including those who receive income from pensions, Social Security, or retirement accounts, are the primary audience for Form 1040-SR. The form is suitable for individuals and couples filing jointly who meet the specific age and income requirements.

Important updates and changes for 2025

As tax laws continue to evolve, the IRS has released a draft for the 2025 Form 1040-SR, showcasing key highlights designed to keep pace with shifting financial landscapes. Notable changes include adjustments to income thresholds for tax brackets and updates to standard deduction amounts, which are particularly relevant for seniors. Such updates could significantly affect overall liability, making it vital for taxpayers to stay informed and compliant.

The new features in the 2025 version expand on user-friendliness with additional online resources and instructions aimed at helping filers navigate their specific situations. The IRS plans to enhance interactive features for electronic filing, reflecting a broader shift towards digital solutions. The comparison of 2025 changes with those of previous years illustrates a consistent trend toward simplifying tax forms and improving accessibility.

Adjusted income thresholds and deduction amounts reflecting inflation and economic conditions.

Improved clarity in reporting requirements to reduce potential errors.

Greater emphasis on accessible electronic filing options.

Eligibility criteria for using Form 1040-SR

To utilize Form 1040-SR, seniors must meet certain eligibility criteria, specifically age and income requirements. The primary condition is that the taxpayer must be 65 years or older by the end of the tax year. This age threshold ensures that the form remains tailored to the unique financial circumstances typically associated with retirement.

For the 2025 tax year, the income thresholds emphasize stability, aiming to help seniors retain more of their pensions and Social Security benefits. Taxpayers whose adjusted gross income (AGI) remains within certain limits—yet may have additional sources such as dividends or retirement distributions—should consider utilizing Form 1040-SR. Important considerations for seniors include understanding how pensions and retirement distributions are treated for tax purposes to make strategic decisions regarding withdrawals that minimize taxable income.

Must be 65 years old or older by December 31, 2025.

Adjusted Gross Income must be below specified thresholds.

Income must primarily stem from pensions, Social Security, and retirement plans.

Step-by-step instructions for filling out 2025 Form 1040-SR

Filling out the 2025 Form 1040-SR can be conducted in a systematic manner, ensuring accuracy and completeness throughout each section. The process begins with Section 1, where taxpayers enter their personal information, including their name, address, and Social Security number. It is crucial to provide accurate personal details, as discrepancies may lead to delays in processing or even penalties.

In Section 2, income reporting is essential. Seniors should be thorough in reporting types of income such as pensions, annuities, dividends from stocks, and distributions from retirement accounts. Common sources of income for seniors typically include Social Security, prompting specific reporting due to its tax treatment based on total income levels. Section 3 addresses deductions and credits, where taxpayers can explore eligible deductions like medical expenses and property taxes, as well as tax credits geared specifically for seniors.

Fill out personal information accurately.

Report all sources of income comprehensively.

Include eligible deductions and consider any available tax credits for seniors.

Calculate tax liability in Section 4 while being mindful of unique scenarios.

Sign and submit the form using available methods.

In Section 4, calculating tax liability involves simple tax calculation steps, ensuring to account for all deduction amounts and credits claimed. Seniors should stay vigilant for common tax scenarios, such as additional taxes on retirement plan distributions. Finally, Section 5 outlines requirements for signing the form, emphasizing the importance of completing the process whether submitting electronically or via mail.

Interactive tools for completing Form 1040-SR

Utilizing pdfFiller’s interactive tools can significantly enhance the experience of completing Form 1040-SR. Users can take advantage of pdfFiller’s editing and eSigning tools to fill out, modify, and eSign their forms swiftly and securely. The platform ensures that key features comply with current tax requirements, making the tax preparation process more efficient.

Accessing interactive templates designed to cater to the specific needs of seniors allows for increased accuracy while minimizing error. Additionally, collaboration features enable couples or teams to file together seamlessly, allowing them to review each other's input in real-time. Utilizing these tools not only simplifies the filing process but also contributes to a more organized approach to managing documents and submissions.

Edit and eSign documents using pdfFiller.

Access interactive templates that cater to seniors’ needs.

Leverage collaboration features for teamwork when filing.

Common mistakes to avoid when filing Form 1040-SR

Filing errors can complicate the tax process, especially for seniors using Form 1040-SR. Common mistakes observed in previous years include omissions of essential income, inaccuracies in personal information, and misidentification of eligible deductions. Such errors can lead to delays in refunds or even penalties, making it essential to adopt thorough review practices.

To minimize filing mistakes, seniors should take the time to validate their documents before submission. Double-checking all entries against relevant tax documents, ensuring that Social Security numbers and financial details align, can alleviate many headaches down the road. Organizing paperwork in advance and consulting with tax professionals can provide added assurance for complex situations.

Ensure all income is accurately reported.

Double-check personal details for accuracy.

Verify eligibility for all deductions claimed.

Frequently asked questions (FAQs) about Form 1040-SR

Seniors often have specific queries related to Form 1040-SR, particularly concerning eligibility and state-specific tax laws. Common concerns include whether Social Security income is taxable, understanding interaction with state taxes, or addressing unique tax situations based on personal circumstances, such as health care costs or alternate income sources. These FAQs provide foundational clarity for seniors preparing to file their taxes.

Tax laws affecting seniors also change, resulting in confusion regarding deductions or exemptions. For instance, is long-term care insurance deductible? The answers to these questions aid taxpayers in ensuring compliance while maximizing their refunds. Furthermore, troubleshooting tips for specific scenarios—like what to do if you can’t find your W-2 or other necessary documents—should be readily accessible to enhance the filing experience.

Is Social Security income taxable under 2025 tax laws?

How do state taxes interact with federal taxes for seniors?

What deductions can seniors claim on 2025 Form 1040-SR?

Resources and additional support

Accessing official IRS resources is vital for seniors preparing to file Form 1040-SR. These resources provide updated information on eligibility, tax laws, and changes relevant to 2025. Besides IRS guidelines, pdfFiller offers robust document management and filing support, empowering users with tools to edit, sign, and collaborate on tax documents effectively. Navigating through these benefits ensures that seniors are well-prepared, compliant, and informed as they approach the tax season.

Additionally, pdfFiller's customer support can assist with queries or technological issues encountered while using the platform. Providing clear guidance helps seniors streamline their tax preparation, ensuring a smoother experience throughout the process. With the right resources and support, seniors can approach filing with confidence, minimizing errors, and enhancing their understanding of practical tax strategies.

Browse IRS resources for detailed filing instructions.

Utilize pdfFiller for document management and filing support.

Contact customer support for assistance with filing questions.

Moving forward: Future outlook and considerations

Looking ahead, it is essential for seniors to stay informed about potential changes that could impact future tax filings. Anticipating changes in deductions, tax credits, and eligibility criteria ensures that retirees remain strategic in their tax planning. With the evolving landscape of tax laws, continuous learning resources, such as workshops or online webinars, can be instrumental for keeping abreast of updates that could potentially affect finances.

Preparing in advance for tax season includes gathering necessary documentation throughout the year and maintaining organized records. When faced with tax complexities, it is recommended that seniors utilize tools like pdfFiller to manage their forms efficiently, collaborate with family members on filings, and gain access to expert advice when needed. By fostering a proactive approach, seniors can navigate tax laws more effectively, maximizing their benefits while minimizing potential liabilities.

Stay informed about potential tax law changes impacting seniors.

Gather necessary documentation throughout the year.

Utilize pdfFiller for efficient document management and collaboration.